The State of K-Pop Entertainment Stocks: A Fun and Insightful Look

Published February 20, 2025

K-pop isn’t just about dazzling performances and addictive tunes—it’s also big business! The financial side of the industry is just as dynamic as the music, and entertainment stocks play a huge role in shaping its future. Ever wondered how companies like HYBE, SM, JYP, and YG are doing financially? Well, grab a seat, because we’re diving into their stock trends. Let’s go!

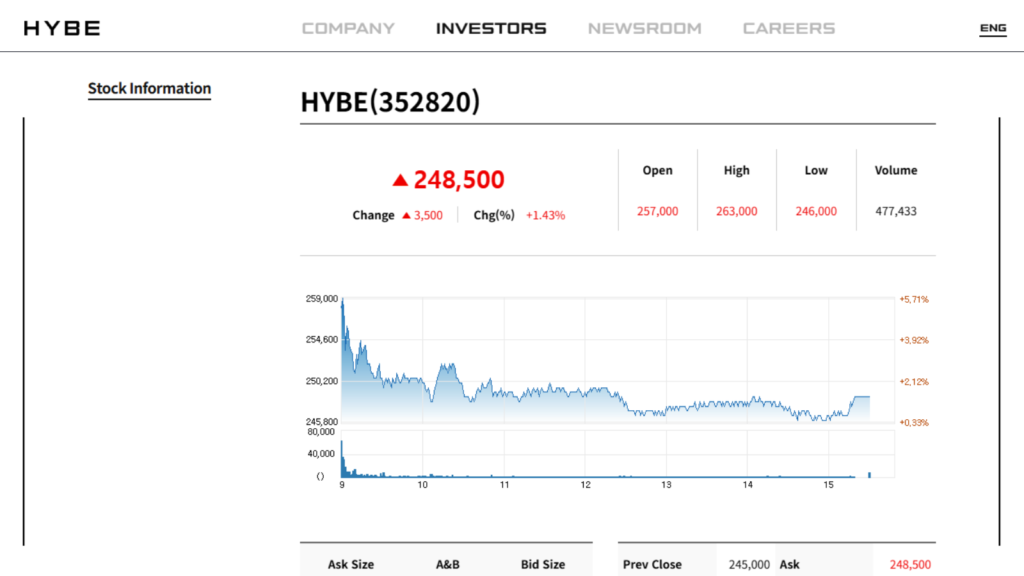

HYBE: Riding the High

HYBE has been on an upward trajectory, and its stock price is currently floating around KRW 248,500.

Thanks to strong album sales, global tours, and major U.S. expansions, the company keeps building on its success. From BTS to its newest stars, HYBE knows how to keep the momentum going. With a market cap of KRW 10.41 trillion and a 13.01% growth over the past year, investors are feeling confident—proving that HYBE isn’t just riding the high, it’s setting the bar.

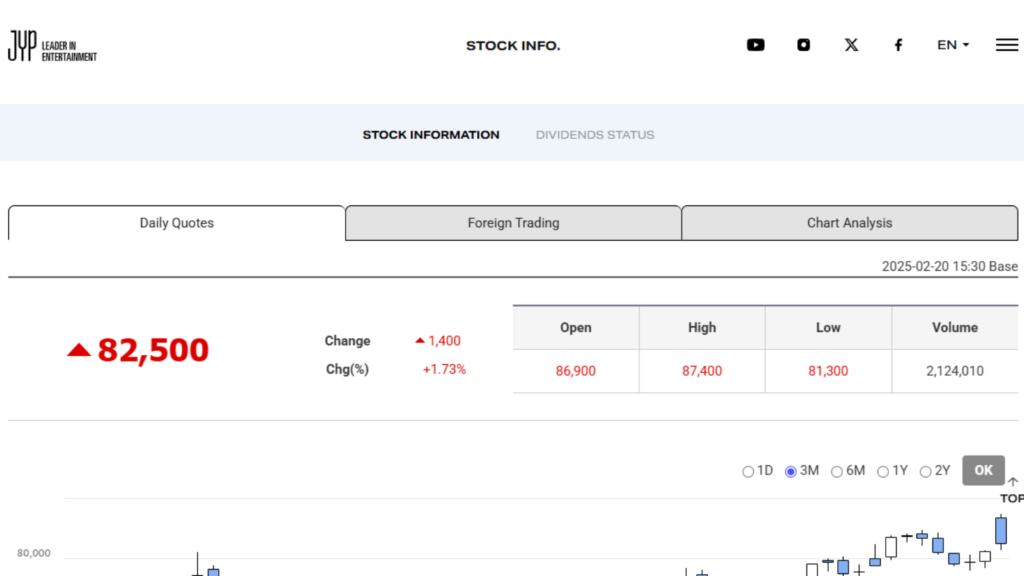

JYP Entertainment: Consistent Performance

JYP Entertainment is all about stability, and its stock is currently trading at KRW 82, 500.

With a powerhouse lineup featuring TWICE, Stray Kids, and ITZY, the company continues to enjoy steady growth. As JYP expands further into international markets and strengthens its artist development strategy, it remains a solid and reliable player in the K-pop business world.

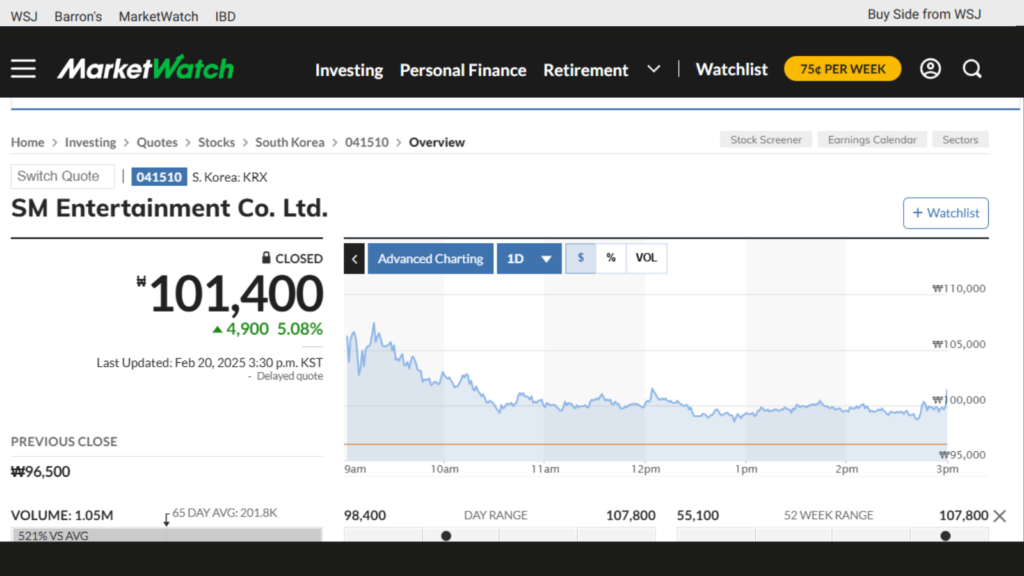

SM Entertainment: Steady Growth

SM Entertainment is another company showing positive movement, with stock prices sitting at KRW 101,400.

Thanks to strategic partnerships, successful artist comebacks, and restructuring efforts under Kakao’s leadership, SM is making waves. Investors are keeping a close watch on how these changes will shape the company’s future, but for now, the outlook is positive.

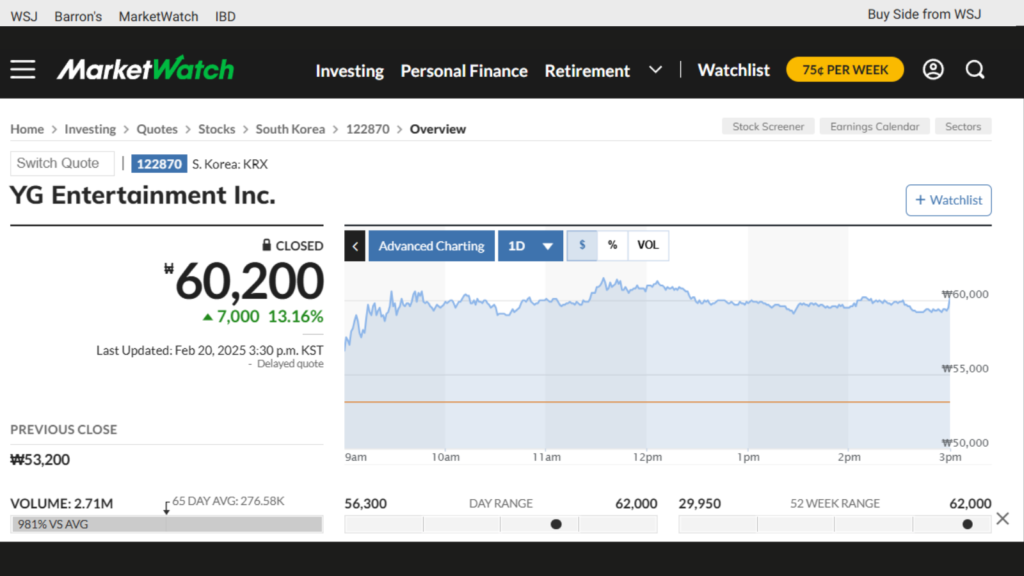

YG Entertainment: Mixed Signals

YG Entertainment’s stock is currently at KRW 60, 200, but the company has seen some ups and downs.

While BLACKPINK’s international success and major brand partnerships provide a strong foundation, uncertainty surrounding contract renewals and new group debuts adds a layer of volatility. YG’s future growth will depend on how well they maintain their star power and introduce fresh talent.

Is Investing in K-Pop Stocks a Good Idea?

A common question among fans and investors is whether entertainment stocks are a solid long-term investment. The answer? It depends on your strategy. The entertainment industry is unpredictable, and trends can change in a heartbeat.

That’s why many investors diversify their portfolios—spreading investments across tech companies, consumer goods, and pharmaceuticals. This way, they’re not putting all their eggs in one basket (or in this case, one K-pop agency!).

At the end of the day, the stock market is a mix of 50% luck and 50% knowledge. Even the best traders struggle with timing the market. If you’re thinking about investing, the golden rule is to only put in money you can afford to lose and focus on long-term growth rather than short-term gains.

As for the K-pop industry, one thing is clear—marketing strategies, artist popularity, and company decisions all play a huge role in stock performance. Whether you’re a casual fan or an aspiring investor, keeping an eye on these trends is both fun and insightful!